Reduce your bank's cost to serve with FileInvite

Slash your financial Document collection turnaround times by up to 80%, and experience an accelerated 'Time to Yes'

Financial processes that rely on physical documents and email attachments have become majorly inconvenient for customers and a significant security risk for banks.

FileInvite automates the collection of all the documents, signatures, files, and data that you require in record time.

Simplify the loan application process

An automated loan application process is a more user-friendly application process. This automation give you more time to engage with your customers directly, while ensuring all documents are successfully - both of which contribute directly to customer satisfaction.

FileInvite includes helpful features like:

- Templated document checklists available in just a few clicks

- Automated SMS and email reminders to keep customers on track

- Admin dashboards to track application statuses

- Automatic PDF conversion

- TFN redaction

Prioritize data security with our encrypted document upload portal

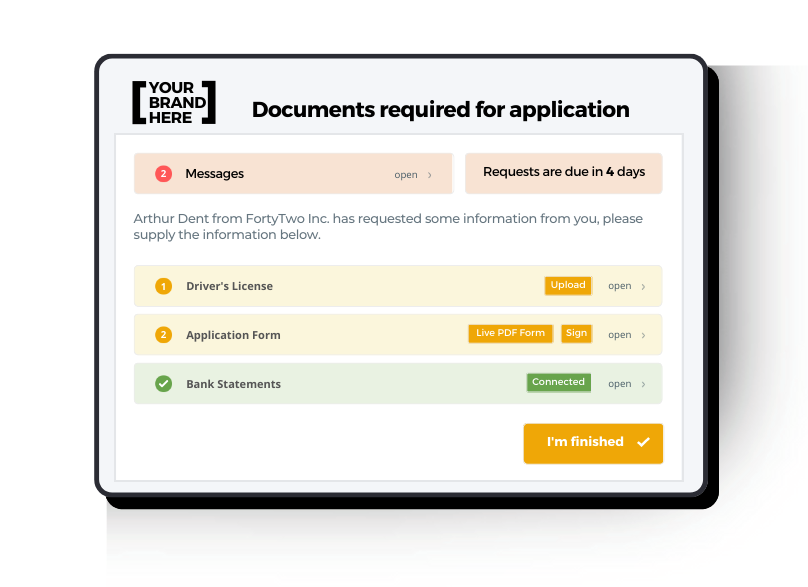

Loan applicants can provide required documents directly into their own secure portal, getting documents out of unsecured email inboxes.

When it comes to their secure FileInvite portals:

- You can password protect their portals

- You can deliver a completely branded experience

- Your borrowers can access and add to their secure portal from any device, even signing documents straight from their phones

Shorten the timeline from Packaging to Underwriting

You and your team can use turnkey templates to send out checklists of documents required, depending on which loan your customer qualifies for.

When it comes to request and collecting information, you can:

- Easily collect KYC requirements

- Quickly and easily review and approve documents from within your admin portal

- Monitor progress of applications to prioritize your most engaged borrowers

- Share applications and documents with internal teams as needed

Explore more resources

Bank Australia experiences fewer backlogs & a faster 'time to yes'

After implementing FileInvite, Bank Australia was able to:

- Speed up loan approvals

- Reduce origination costs

- Enhance customer satisfaction

Australia’s Upcoming Data Privacy Changes — Implications for Different Industries

Stay ahead by gaining insights into Australia's evolving data privacy regulations and their specific impact on your industry.

How to Balance Security with a Frictionless Client Onboarding Process

Learn how to deliver a seamless and efficient onboarding experience for your clients, while also safeguarding all personally identifiable information (PII).

AI in Commercial Lending: High Risk or High Reward?

Explore the impact of AI in commercial loan origination - reducing human error, improving customer experience, and appealing to a broader customer base.

The banking experience your customers deserve

FileInvite now powers ⅓ of Brokered loans in Australia and has collected over 7,000 5-star reviews in the process. Provide the best possible experience for your members today.