Boost Efficiency: The Power of SBA Loan Software for Lenders

SBA loan software is an important tool for modern banking and financial services. These platforms streamline the lending process for Small Business...

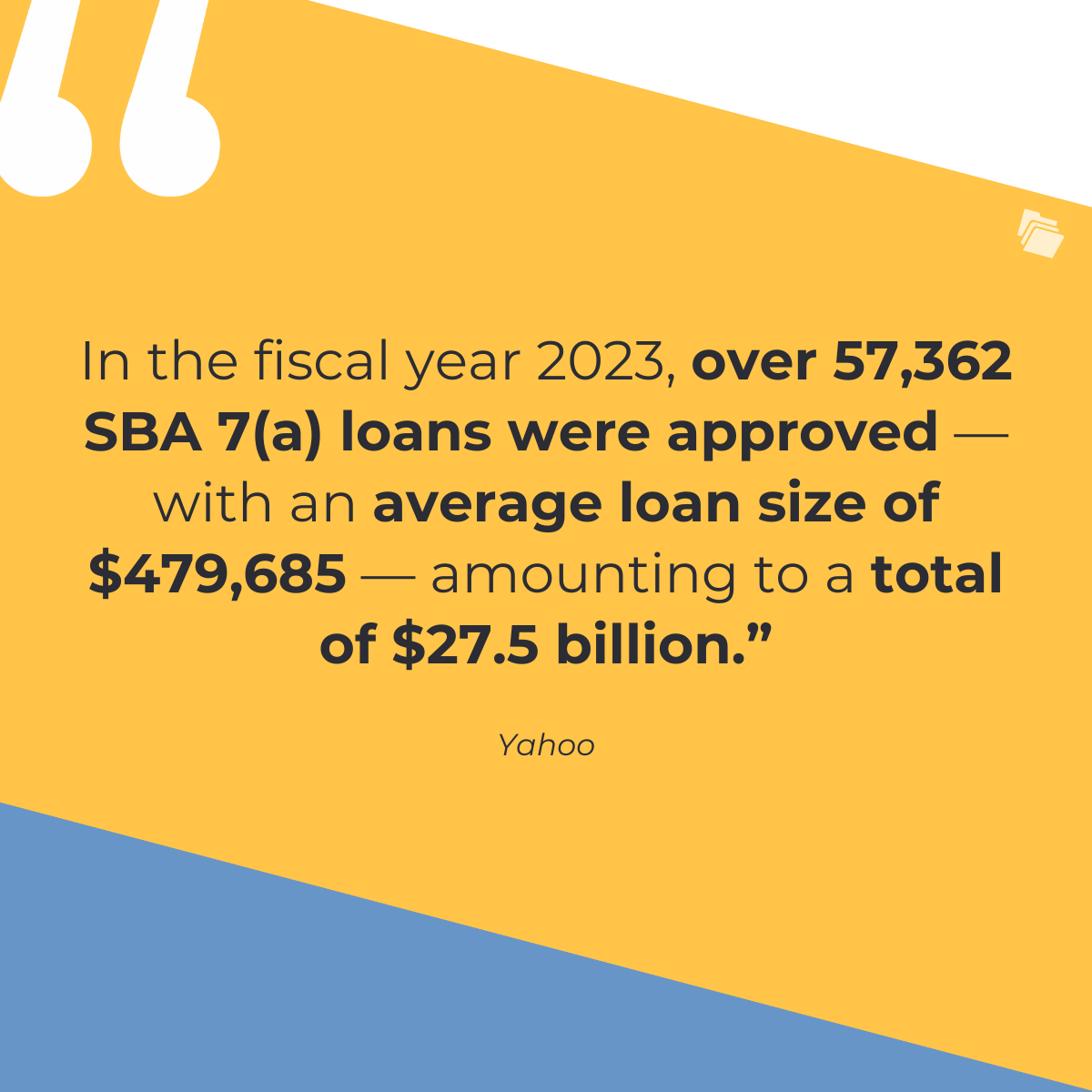

In financial services, brokers in Small Business Administration (SBA) transactions help thousands of small businesses obtain the funds they need to survive and thrive. SBA loans provide a vital source of financing for small business owners across the United States, enabling them to start, grow, and sustain their operations. In the fiscal year 2023, over 57,362 SBA 7(a) loans were approved — with an average loan size of $479,685 — amounting to a total of $27.5 billion.

Brokers play a crucial role in facilitating these transactions by connecting borrowers with the right lenders and ensuring that the loan products meet the unique needs of each small business. The importance of this role is underscored by the significant amount of funding involved and the substantial number of these approvals — over 21,000 — were for startups and businesses with fewer than two years in operation.

Given the competitive nature of SBA lending, with approval rates varying widely by institution type, the expertise of a broker can be the difference between approval and denial. For instance, large national banks have an average loan approval rate of 13.8%, while small banks have a higher rate of approval at 19%. These statistics highlight the competitive landscape of SBA lending and the value brokers add in navigating it successfully.

As such, understanding the dynamics of SBA lending and the strategies for effective brokerage is essential for the sustained growth and success of small businesses. This guide examines how brokers can effectively manage the SBA process for clients.

Understanding the Small Business Administration (SBA) landscape requires an overview of the diverse lending programs offered by the SBA, the eligibility criteria for these loans, and the importance of these programs in supporting small businesses.

The SBA provides a range of loan programs to assist small businesses, each designed for specific needs. The 7(a) loan program is the most common and versatile, offering guarantees on loans for a variety of general business purposes. The 504 loan program is for purchasing major fixed assets, such as real estate or equipment, that promote business growth and job creation. Microloans provide smaller loan amounts, typically $50,000 or less, to help startups and small businesses grow and expand.

Eligibility for SBA loans is generally determined by several factors:

Most businesses need to meet SBA size standards, prove their ability to repay the loan and have a clear business purpose. The SBA sets these guidelines to reduce lender risk, which in turn makes it easier for small businesses to obtain loans with favorable terms, such as competitive rates and fees, lower down payments, and flexible overhead requirements.

The SBA's role is crucial in supporting small businesses, which are fundamental to the U.S. economy. They do this by partnering with lenders to increase access to loans, providing disaster relief, and offering counseling and education to support business operations. In the fiscal year 2023, the SBA has made significant strides by implementing policies to modernize their signature loan programs, expanding access to capital for small businesses.

For example, nearly 70% of the SBA’s 7(a) loan volume in 2023 comprised small-dollar loans of $350,000 or less, indicating a focus on supporting small and emerging businesses which are often the backbone of community development and economic growth.

A successful SBA broker embodies a set of core qualities that enable them to navigate the complexities of SBA loans effectively and ethically. Here are some of these key qualities:

A successful broker must have a comprehensive understanding of various SBA loan programs, such as the 7(a), 504, and microloan programs. They should be well-versed in the latest changes to SBA regulations, which can directly impact borrowers' eligibility and the terms of loans.

Effective communication is crucial for brokers to articulate the benefits and intricacies of SBA loans to clients. Negotiation skills are equally important, as brokers often need to negotiate terms with lenders on behalf of their clients to secure the best possible loan outcomes.

SBA brokers should have a solid grasp of the challenges and opportunities small businesses face, tailoring loan solutions to fit the specific financial and operational needs of these enterprises.

Adherence to high ethical standards and legal requirements is non-negotiable. Brokers must conduct due diligence and operate with integrity to maintain trust and a good reputation in the industry.

Statistically, brokers who demonstrate these qualities contribute to the high success rate of SBA loan approvals. As fewer than one in five SBA applications secure approval, brokers who can effectively navigate the SBA landscape and lender relationships are pivotal in achieving favorable outcomes.

Brokers who embody these characteristics often have:

A broker's ability to combine these qualities effectively can significantly influence the success and growth of small businesses seeking SBA loans.

Preparing clients for SBA transactions is a process that requires thorough education about the programs, meticulous assistance with documentation and application, and strategic advice to enhance their creditworthiness. Here's how a broker or financial advisor can guide clients through this process:

Clients should be informed about the different SBA loan programs, such as the 7(a), 504, and microloan programs, and how they can benefit their business. This includes explaining the purpose of each loan, the terms, and how they compare to conventional loan products.

Gathering and preparing the necessary documentation is often the most daunting part of the loan process. Advisors should help clients compile financial statements, business plans, and other required documents, ensuring accuracy and completeness to avoid delays or denials.

This can include strategies for improving their credit score, managing existing debts, and demonstrating a solid plan for the use of funds. Advisors should work with clients to make any necessary adjustments to their business operations or financial practices that could improve loan eligibility.

Key documents typically required include:

Navigating the SBA loan application process requires a structured approach and choosing the right fintech tools. Using a secure portal for document collection — like FileInvite — can greatly facilitate this process.

Assisted by FileInvite, the process involves these steps:

Begin by familiarizing clients with SBA loan options and the benefits of each.

Use FileInvite to request and collect the necessary documents from clients in a secure, organized manner. As SBA approvals typically take 30-90 days, expediting document collection is one of the most value-adding tasks a broker can render an SBA applicant.

Once all documents are gathered, help clients submit their applications through the proper channels, ensuring all forms and additional requirements are met.

Use FileInvite's admin portal to track the progress of document collection tasks and application statuses, focusing on clients who are actively engaging and completing tasks.

Common challenges include gathering numerous documents and meeting stringent KYC requirements. FileInvite streamlines these tasks by allowing brokers to:

This system can significantly speed up the collection of sensitive information, ensuring a more efficient application process for borrowers. With FileInvite, the average document turnaround time can be reduced, leading to faster loan approvals and an enhanced client experience.

Post-transaction support is critical for ensuring that clients are well-positioned to use their SBA loans effectively and prepare for future financial needs. This support involves:

The use of FileInvite can enhance the post-transaction experience by simplifying document management and enabling real-time progress tracking, which is crucial as 96% of SBA recipients spend their loaned funds within 12 months. By maintaining a robust support system and leveraging efficient tools like FileInvite, brokers can provide valuable assistance that aligns with the evolving needs of their clients.

FileInvite enhances the efficiency of SBA brokers by streamlining document collection and ongoing communication throughout the entire loan process. FileInvite simplifies gathering the necessary paperwork, ensures accurate and timely application submissions, and offers real-time tracking of a client's application progress. Integrating FileInvite can transform the SBA transaction experience for brokers and clients alike, from initial consultation to loan approval and beyond, reinforcing a broker's role as an indispensable resource in connecting small businesses to critical funding.

To learn more and request a demo, visit FileInvite today.

SBA loan software is an important tool for modern banking and financial services. These platforms streamline the lending process for Small Business...

The Small Business Administration (SBA) assists small business owners throughout the development process. One of the most valuable services the SBA...

SBA loans are a type of small business loan partially guaranteed by the federal government – the Small Business Administration – that mitigate the...