Home purchases spiked following the low-interest rates offered during temporary COVID-19 restrictions, with estimates now placing the total loan origination market value for 2020 to 2022 at $2.5 trillion – a 40% increase from the total value for the previous decade. Continuing a trend that goes back to the 1980s, mortgage brokers are also handling a greater share of loan originations, accounting for as much as 70% in markets such as Australia.

With the demand for mortgage brokering services remaining on the rise for the foreseeable future, leveraging the right tools to maximize productivity has become more important than ever before.

Here's a list of six tools brokers should consider using to keep processes flowing smoothly and clients happy.

1. Point of Sale (POS) System

Point of sale (POS) systems in the mortgage industry give brokers a client-facing software solution that enables online applications and client portals for the necessary documentation. POSs supply the front-end to loan origination systems.

2. Loan Origination System (LOS)

Loan origination systems (LOS) automate many of the end-to-end steps in the loan approval process. These will typically include tasks related to:

- Application Receipt

- Underwriting

- Document Collection

- Pricing

- Funding

While POSs digitize tasks for applicants, LOSs do the same for brokers and loan officers.

3. Customer Relationship Management (CRM) Software

Customer relationship management (CRM) software is not unique to the mortgage industry and refers to a software-as-a-service (SaaS) platform that people in nearly all industries use to build and maintain better customer relationships by centralizing and organizing a complete record of client interactions.

Across the board, CRMs often:

- Boost conversion rates by 300%

- Improve customer retention by 27%

- Increase revenue per sale by 41%

In the context of mortgage brokering, CRMs help brokers manage large networks of clients and leads without the hassle and risk of trying to remember every little detail. CRMs typically create unified customer profiles where users can see all customer data from other integrated systems.

This helps with client relationships as users always have access to complete records of interactions and can provide more personalized service while using automated reminders to keep everyone on the same page.

4. Configured Smart Inboxes

Email can prove to be a challenging platform for maintaining effective communications with large client bases. Attachments get lost, sometimes relevant information exists in multiple threads, and manually reassembling everything can quickly become a major time sink. Studies estimate that brokers spend as much as 2-3 hours a day sorting through their inboxes.

Nevertheless, some services such as Gmail have configurable features with better routing and notifications. While these features will certainly improve upon the chaos of default settings, the burden still falls on the user to create filters and notifications that meet their specific needs.

5. Digital Identity Verification

With identity theft losses doubling every year in the last three years, financial institutions and brokering services have an increased responsibility to verify client identities with modern digital methods. These methods include multifactor authentication and – in some cases – biometrics such as retinal scans. Multifactor authentication can involve the use of separate, unrelated credentials such as email addresses, phone numbers, and social media accounts that would be exceedingly unlikely for an imposture to have simultaneously.

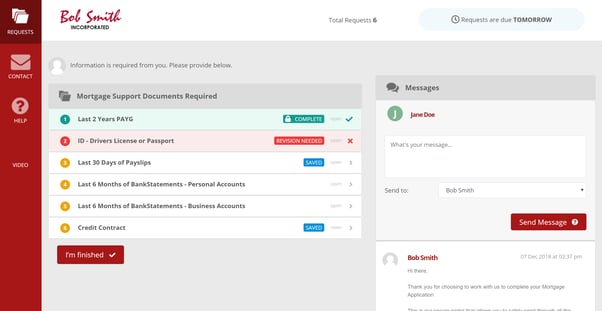

6. Client Document Portal

Automated client document portals combine many of the features of CRMs, LOSs, and POSs in a single user interface. In these systems, clients can upload loan application documents securely to a single repository. Loan officers can manage applications with notifications for themselves and clients when deadlines are missed or impending.

Similar to cloud-based file sharing services such as DropBox and Google Drive, automated collection portals help clients and brokers find all information and documentation in one place, with more sophisticated features such as e-signature requests and automated process monitoring.

How to Set Up a Client Portal for Mortgage Documents

To set up a client portal that collects all the files and info for a loan application, the ideal layout includes:

- An introduction to the process

- A clear outline of the documents required, this could include

- ID in the form of a passport or driver's license

- bank statements for personal or business accounts

- payslips

- a credit contract

- your disclosure statement

- A fact find form.

- Descriptions of the items required and why you need them

- Some methods of contact, should they need to clarity anything

- A due date

- A submit and sync button when the process is complete.

Create a “Read Me” or “Watch This First” file

This is great for first time buyers, but also those who have not applied for a loan in a while. It pays to give a clear outline. Start with "what's required" for the type of application that you are requesting for. That might be a new home, investment property, vacation home or for a self employed applicant.

Reiterate some of the messaging you used in the email that you sent with their portal link. Use a “Watch This First” video here, to add a bit of personality and to avoid the email misunderstandings.

Clearly outline each individual item they need to submit

Step your way through the documents required. State the format you need them in, the validity or period they need to cover and the intended use. This can go a long way to ensuring that things get done once and done right. It can ensure colour copies not black and white, and a full 6 months of bank statements for example.

You can also stipulate exactly which parties need to to what. The primary, secondary or both applicants.

A detailed fact find document

A large part of the information you need can be obtained using a fact find form. The quality of this data and your questions has a massive impact on your ability to prepare. It ensures you are tailoring their mortgage solution to their unique situation.

Offer contact methods that keep a record of communications

One way to ensure all client communications are in one secure spot, is to provide a chat widget. Good chat tools will let clients message you from within the portal, but let you reply via email - back into the chat.

This method saves all the messages into the chat history, which is ideal for compliance.

Set a due date and follow up

This isn't usually part of a standard client portal, but setting due dates for documents is a great trick to put in place. You could also setup an automated reminder to let them know when these documents are due.

Enabling this with document collection software like FileInvite, ensures that you get the documents on time. It follows up with clients when the files become due and past their due by date so you don't have to.

Submit and sync your client portal to secure cloud storage

A submit button allows you to close the process off. From an audit and compliance you have a defined set of files they have submitted at that time and date. It also allows you to lock off the ability for them to upload or submit alternative files.

Ensure you sync your portals to your preferred cloud storage. You can then access the files from any internet enabled device.

Which means you can edits files, review them on the go and collate them. Perfect for bundling a PDF to pass on to the chosen lender at a later stage.

Benefits of the Right Tools

Every financial institution – and brokerage – is different. They have different processes and work with clients who bring unique needs to the table. Choosing the right toolset for your organization requires looking at the bigger picture of what you want technology to do for you.

Your solution should accomplish at least these four transformations regardless of its configuration.

- Cloud Migration: Digital transformation has brought commerce to the cloud. Your operations should join the migration.

- Enhanced Workflows: CRMs and document collection platforms create visibility into processes. This visibility should always give insight into redesigned, enhanced workflows.

- Integration: Today’s businesses run on an increasingly complex web of applications and third-party service providers. The tools you choose should integrate and declutter, not complicate.

- Frictionless Technologies: Smart leaders in today’s tech-heavy environment will pay attention to what their teams already use. Change is inevitable but making choices to match your team’s habits and preferences will pay off in the long run.

Automated Document Collection with FileInvite

FileInvite’s SOC 2 Type 2 compliant document collection platform gives mortgage brokers a one-stop shop for solutions to today’s evolving needs. The platform enables clients to move documentation swiftly and securely – via 256-bit encryption – and gives brokerages a fully featured suite of tools to manage and automate processes, cutting turnaround times drastically.

To learn more and request a demo, visit FileInvite today.

Related Posts: