In a period of intensely accelerated digital transformation, organizations in all industries and sectors struggle to reshape previously fragmented, ad hoc processes – straddling different eras of technology – into streamlined, efficient workflows. For banking institutions, the challenges of secure document collection remain at the top of the stack.

What is Automated Document Collection?

Automated document collection refers to the use of an online software platform to streamline the process of collecting different kinds of documents, forms, and other data from clients. Similar to cloud-based filesharing services like Dropbox, OneDrive, and Google Drive, an automated collection platform creates a single upload pipeline for documentation entering an organization’s repository.

Beyond organized filesharing, automated document collection also enables more sophisticated features such as e-signature request and retrieval, automated process monitoring, and scheduled reminders for missing documents near deadlines. These features make automated document collection a powerful tool for improving efficiency and cost-effectiveness in any organization that handles large volumes of sensitive documents and client data. Automated document collection has broad applications across many industries, including:

- Banking and Finance

- Law

- Education

- Healthcare

- Enterprise Commerce and Professional Services

In these listed fields, organizations still tend to collect documents from clients through a disorganized assortment of channels such as hard copies by mail, email attachments, and digital files uploaded and stored in unintegrated systems. Automating document collection in a single upload pipeline with a single comprehensive record of documents received resolves inefficiencies and the risks of unorganized legacy collection methods.

Automated Document Collection for Banking Institutions

For banking and lending institutions, adopting automated document collection has the potential for sweeping operational benefits. Most lending transactions require efficient document processing within fixed timeframes. Processing approvals and loans – both commercial and consumer – still typically involve files of paper and digital documents such as:

- Bank Statements

- Profit and Loss Statements

- Signatures

- Notarizations

- Accounts Payable Documentation

- Inventories

Collecting these documents through document portals can secure and speed up processing while reducing the chance of errors or documents lost in extended email threads. As clients continue to expect more real-time, omnichannel options for interacting with businesses, automating document collection can help banking institutions achieve higher standards of performance and customer satisfaction.

7 Automated Document Collection Benefits for Banking Institutions

Here is a list of seven benefits document automation reliably provides banking and finance institutions.

1. Cost Reduction

Automated document collection reduces costs in two ways.

-

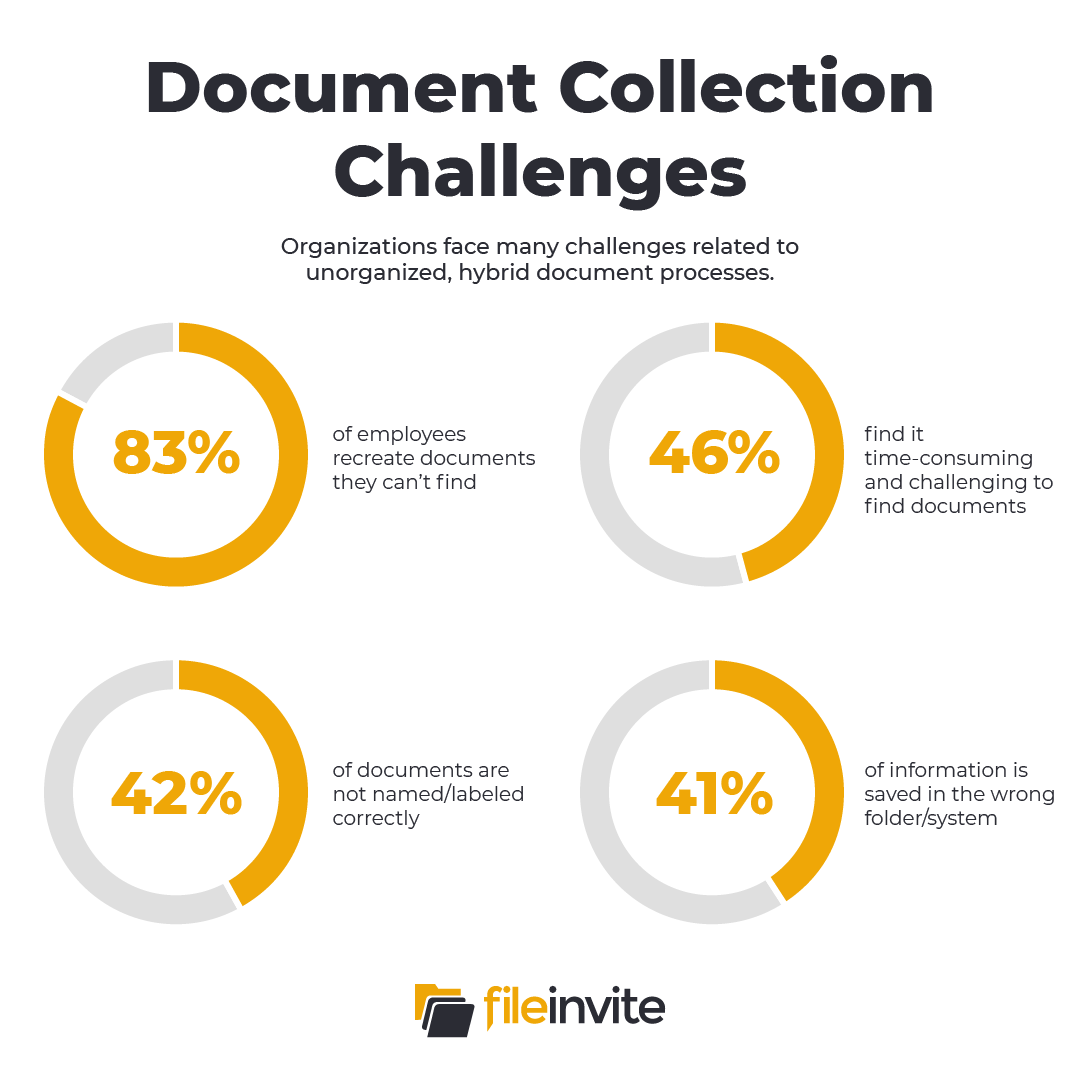

Reduced Physical Resource Consumption: Paper filing processes are inefficient and expensive. Companies spend approximately $20 to file and store paper documents and – in the process – misplace 7.5%. Replacing paper processes with digital solutions saves companies an average of 40% of their total document management costs.

-

Reduced Skilled Labor Hours: In most offices, trained professionals tend to spend as much time locating scattered information as they do in communication with their clients. Consolidating document collection in one place can free up a significant amount of time for your valuable workers.

2. Error Reduction

Manually collecting information scattered across systems and formats compounds the chances for errors to enter your files. On average, human data entry without verification processes has an error rate of around 4%. If your staff searches for information toggling between the enterprise average of 35 different job-related applications daily, you can be certain multiple – potentially costly – errors are propagating in your files regularly. Having a single integrated platform for automated document collection drastically reduces the error-prone vulnerabilities in your regular document processes.

3. Enable Clients to Interact Directly Through Portals

How clients interact with their banking institutions is evolving. Client adoption of digital and mobile services is on the rise and with it comes an opportunity to create positive engagement and connection. As 24-7 omnichannel communication increasingly becomes the standard for business-client relationships, giving clients options to communicate directly and have live visibility into their own data aligns clients’ banking experiences with their preferred digital modes of interaction.. Additionally, automated document collection channels allow clients to upload missing documents immediately, reducing lag time when items have been forgotten.

4. Faster Turnaround Times

In effect, the lending industry as a whole faces systemic downtime somewhere between a third and half the time. With automated data collection, banking institutions can expect an average 34% reduction in document turnaround times. With more time to engage clients directly, bankers can improve overall customer satisfaction, shorten their sales cycles, and satisfy audit requests more efficiently.

5. System-wide Visibility and a Single Source of Truth

Without a central upload pipeline to a monitored system, accurately assessing the status of applications and approvals at any point in time can require hours of time spent sorting lengthy email threads and gathering information through calls and texts. The longer this process continues, the more chances for error and oversight arise.

In an automated system, everyone in the process can see exactly what documents have been received and when. As this information is logged in a single authoritative source, there is minimal chance for confusion of miscommunication over the status of a particular file.

6. Automation of Repetitive Manual Tasks for Agents

In traditional document collection processes, agents spend a significant amount of time maintaining contact with clients and chasing them down for information through follow-up calls, emails, and texts. With automated document collection software, you can enter critical dates into your calendar and set automated reminders through your preferred range of channels. Automating these repetitive tasks not only saves time and hassle. It also ensures that neither you nor your clients miss important deadlines.

7. Security and Compliance

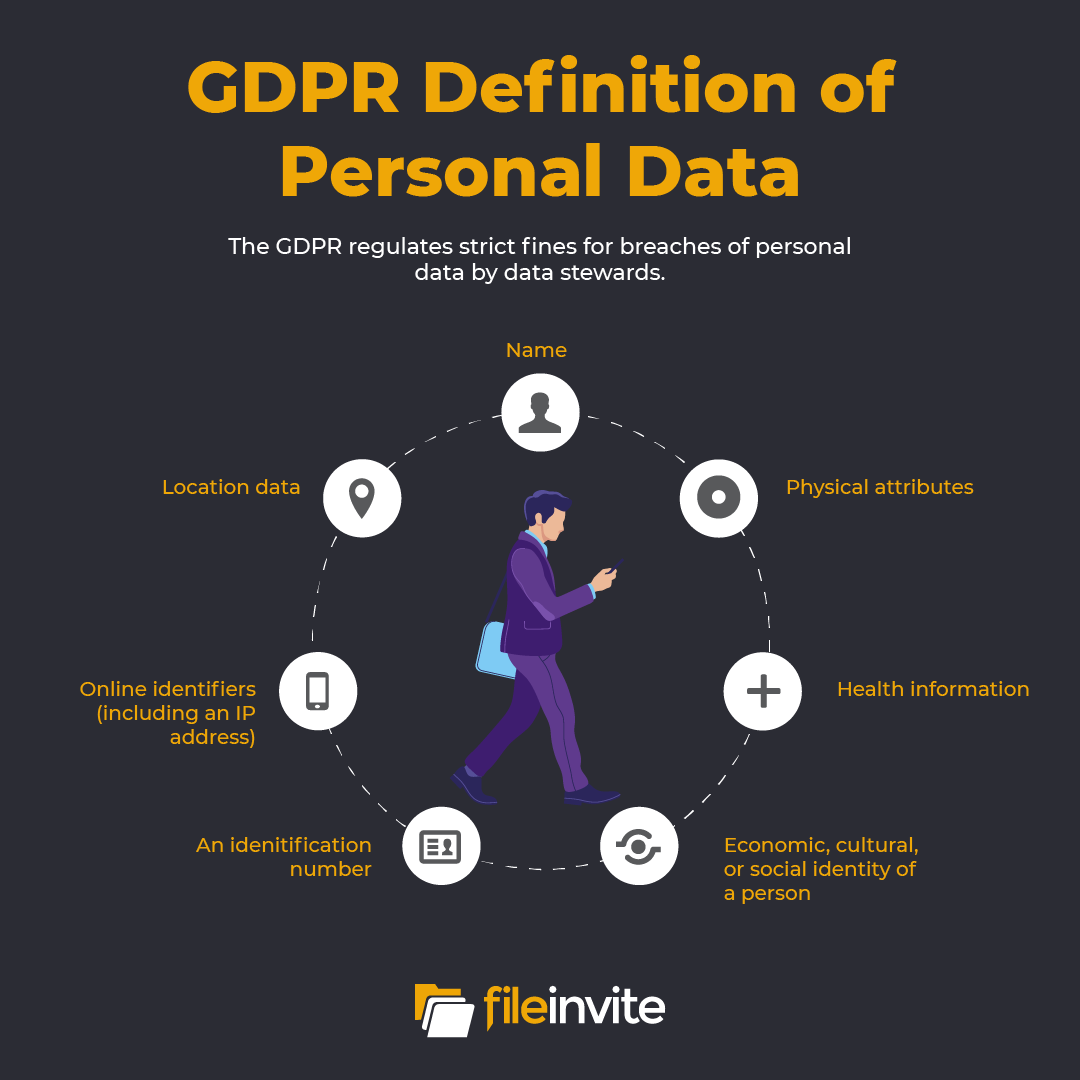

Breaches of personal or financial data within your organization or third-party service providers you contract are more than just a single incident that damages your professional reputation. In today’s data-driven world, improper or reckless handling of sensitive information represents serious – potentially catastrophic – legal liabilities.

In Europe, the General Data Protection Regulation (GDPR) fines companies for personal data breaches, with a maximum of the higher of 4% of total revenue or €20 million. While no precisely comparable punitive regulation exists in the United States, recent posturing by the FTC and the Cybersecurity and Infrastructure Security Agency (CISA) indicates a broad intent to treat data stewardship as a public safety matter.

As the outsourcing of critical IT functions to Software-as-a-Service (SaaS) providers increasingly becomes the norm, assessing and mitigating legal risks becomes integral to data collection practices. With the right platform, automated data collection can help your organization address this challenge.

In a market where IT staff are reluctant to take SaaS providers’ claims about security standards at face value, accepted third-party credentials can give you confidence in your choice of services. For automated data collection platforms, the banking-grade standard for data security is certified compliance with the System and Organization Controls (SOC) 2, Type 2 audit. In this process, data handlers not only open their systems to auditors. They must also supply the auditing institution with a year’s worth of implementation proofs from their own logs.

Document Collection on Autopilot with FileInvite

Regardless of the size and experience of your organization, chances are extended document return times are hitting you hard at the bottom line and costing you clients. FileInvite specializes in automated document collection to drive pipeline velocity. With bank-grade security and guaranteed 99.9% service uptime, FileInvite provides unrivaled data collection solutions for banking institutions.

To learn more and request a demo, visit FileInvite today.

Related Posts: