In nearly every industry, the pace of digital operations has accelerated during the last two years. Despite their traditionally risk-averse and innovation-resistant posture, even lending institutions have felt the pressure to give clients more of the online, self-service, and mobile options they’ve come to expect in customer experiences. Adapting to evolving customer preferences for technologies such as client portals while maintaining secure document collection practices has become a timely challenge for banking institutions in 2022.

For most organizations, breaking up bottlenecks and getting documents, signatures, forms, and other kinds of data into complete protected files quickly will mean adopting the right technologies. In this blog, you’ll learn what secure document collection is and how banking institutions should evaluate document and data collection platforms.

What is a Data Collection Platform?

A data collection platform, also referred to as a document collection platform, is a kind of software used by organizations to electronically collect and store information from users, customers, or clients. Industries and sectors that commonly use data collection platforms include:

- Banking and finance

- Law

- Education

- Healthcare

- Enterprise commerce and professional services

Organizations in these fields use these platforms to simplify the input and retrieval of multiple data types. 85% of organizations around the globe have accelerated their plans for digital transformation in the last two years. Nevertheless, most still collect vital operational data from customers and clients in an unwieldy patchwork of paper documents, email attachments, and files created and stored in partitioned systems.

Document collection platforms tackle this organizational pain point. Whether in the form of loan applications, medical records, or enterprise customer data, disorganized data collection methods take a costly toll. Manually reassembling data from various mismatched sources not only consumes time and labor, but it also results in lost documentation and potential legal liabilities.

Data Collection Platforms in Banking Institutions

Consolidating data collection in a unified online platform can significantly improve the operational efficiency of any kind of organization that traffics in high volumes of information supplied by clients or their representatives. Banking and financial institutions, in particular, can benefit from the use of a secure online portal for clients to upload private and time-sensitive documents.

In both consumer and commercial contexts, banks face an industry-unique set of data collection challenges. The data exchanged between institutions and clients frequently involves the secure handling and authentication of valuable, legally sensitive information. Additionally, most transactions relating to applications require processing within narrow timeframes. For banks, data collection platforms can facilitate the assembly of complicated files including:

- Bank statements

- Profit and loss statements

- Signatures

- Notarizations

- Accounts payable documentation

- Inventories

Banks still accept most of these document types in both paper and digital formats, leaving many unresolved bottlenecks and vulnerabilities in their processing workflows. As digital transformation continues to accelerate across industries, customers increasingly expect seamless, secure, and transparent experiences from the businesses they choose. To meet these challenges and thrive in a fast-paced digital environment, banks need reliable, streamlined data collection methods now more than ever.

4 Key Features in Banking Data Collection Platforms

While a data collection platform could be simply a user-end client portal for uploading documents or a series of forms built into an organization’s own software, banking institutions should insist upon certain security and performance features in any platform they adopt.

1. System and Organization Controls Reports

For agility and scalability, third-party Software-as-a-Service (SaaS) platforms have increasingly become the go-to solution for nearly everyone when it comes to expanding IT capabilities. The global SaaS market is currently growing by 18% every year, and by the end of 2021, 99% of organizations reported using at least one SaaS solution.

It’s easy to understand why. Subscription-based services require little investment up front and allow organizations to immediately onboard a high level of professional expertise. With automated access to upgrades and maintenance, organizations can focus on their own tasks without trying to maintain a world-class in-house IT department.

Nevertheless, the SaaS industry continues to face various security and transparency challenges. Security experts estimate that as much as 40% of all SaaS data assets are unmanaged and vulnerable to internal and external breaches. For this reason, IT decision-makers remain skeptical of most vendors’ claims about their internal standards.

To evaluate a SaaS provider’s security standards externally, organizations can refer to the System and Organization Controls (SOC) developed by the American Institute of CPAs. For mitigating potential legal liabilities of handling sensitive information, SOC compliance – particularly SOC 2 Type 2 for SaaS providers – has become the gold standard for trust. To obtain a SOC 2 Type 2 certification, an organization not only has to open their systems and inventories of controls to auditors for inspection. They also need to provide auditors with logged examples of how those controls were implemented for a year.

For banking institutions, SOC 2 Type 2 compliance should be a non-negotiable feature in secure data collection platforms.

2. 256-Bit Encryption

The Advanced Encryption Standard (AES) is an encryption algorithm developed by the U.S. government to protect classified information. AES uses a symmetric block cipher that requires the same key for both encrypting and decrypting. Security experts consider AES impenetrable to cracking by all attack methods except brute force. Encryptors can choose from 128, 196, and 256-bit ciphers. 256-bit encryption is the highest possible standard for securing the transmission of financial information in data collection services.

3. Advanced User Provisioning

In IT, user provisioning refers to the Identity and Access Management (IAM) process for creating and maintaining user accounts and assigning authorizations to them. Today’s IT environment requires that organizations manage multiple, complex tiers of authorizations and authentications. In these tiers, both users and data may be temporary or dependent on on- or off-site access.

Managing these protocols securely and efficiently involves assessing the needs of your organization and breaking your internal provisioning processes down into four access types.

- Self-service: Tasks users perform for themselves such as password management

- Discretionary: Permissions granted by the personal approval of IT staff

- Workflow-based: Permissions determined by user roles

- Automated: Configuring any of the previous processes in advance at the system level

To maintain advanced user provisioning practices, IT experts recommend the four-step process outlined below.

In choosing a data collection platform, banking institutions should consider the sophistication of the user provisioning practices employed by the service provider.

4. Integration with Existing Software

Data collection platforms exist to help your organization to assemble necessary information more securely and efficiently than is otherwise possible in unorganized, hybrid processes of paper and digital intake. If a platform cannot be configured to work with the systems you already use, it may introduce more problems than it solves.

A long-term, scalable solution will natively integrate with the industry’s most common cloud storage services such as Dropbox, OneDrive, and Google Drive. It will also accommodate custom integrations and handle unique suites of APIs from other critical software services such as customer relationship management (CRM) services and loan origination systems.

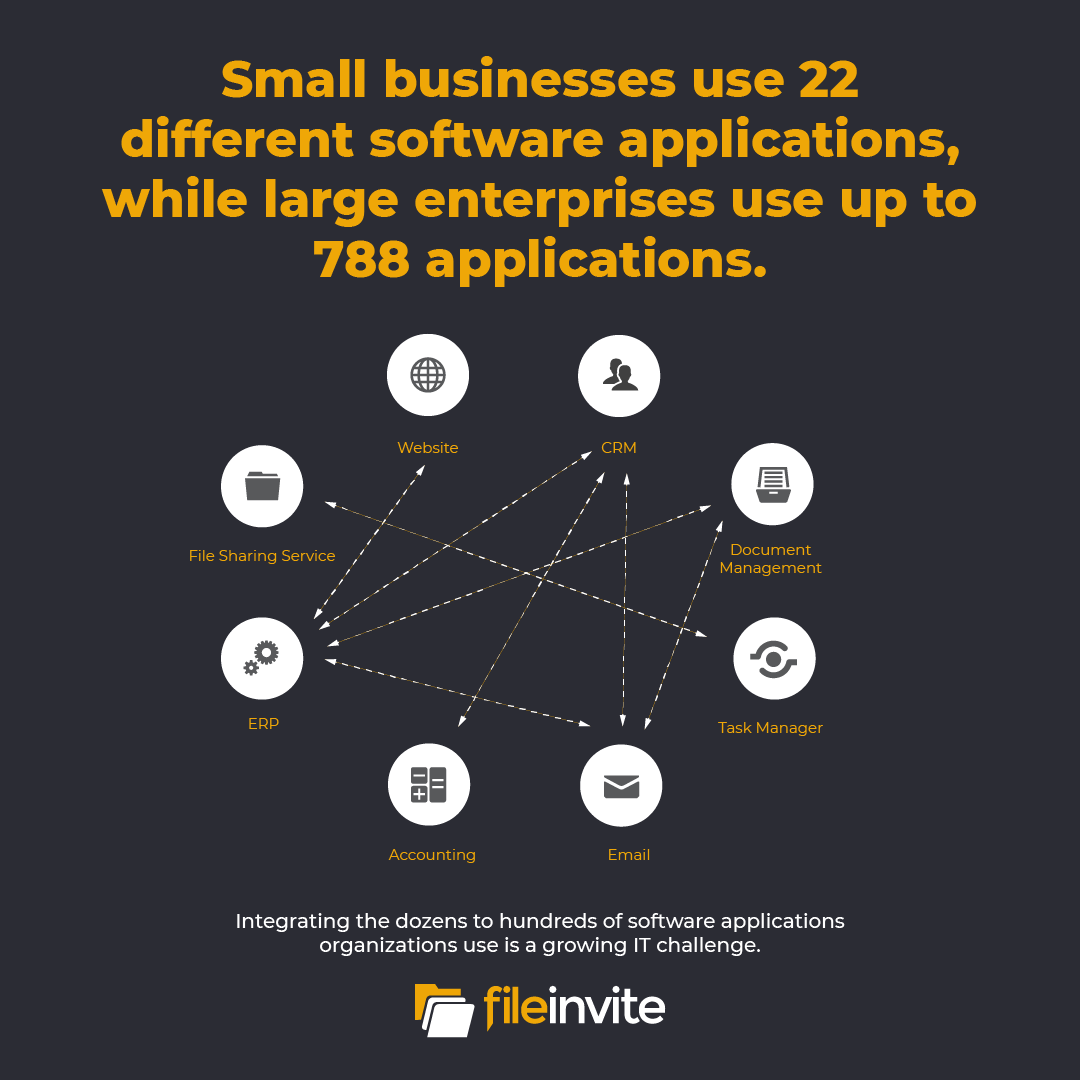

Custom coding software integrations have become increasingly expensive and incompatible with scaling. Today’s businesses with more than 50,000 employees use, on average, 788 different software applications in their day-to-day operations. To reap the benefits of data collection without driving up costs and IT workloads, organizations need the ability to create custom integrations and workflows without writing new code for every change. For banking institutions, data collection platforms that work with no-code, web integration tools such as Zapier will provide the most cost-effective and capable solutions.

Enjoy the Benefits of a Secure Data & Document Collection Platform with FileInvite

FileInvite’s digital workflow automation solutions for client data collection can shift your workflows into high gear, with clients experiencing, on average, a 34% decrease in turnaround times. FileInvite combines bank-grade, SOC 2-compliant security with seamless no-code integration for the software you already use.

To learn more and request a demo, visit FileInvite today.